Gladstone Land Announces First Quarter 2021 Results

ACCESS Newswire

13 May 2021, 02:01 GMT+10

Please note that the limited information that follows in this press release is a summary and is not adequate for making an informed investment decision.

MCLEAN, VA / ACCESSWIRE / May 12, 2021 / Gladstone Land Corporation (NASDAQ:LAND) ('Gladstone Land' or the 'Company') today reported financial results for the first quarter ended March 31, 2021. A description of funds from operations ('FFO'), core FFO ('CFFO'), adjusted FFO ('AFFO'), and net asset value ('NAV'), all non-GAAP (generally accepted accounting principles in the United States) financial measures, appear at the end of this press release. All per-share references are to fully-diluted, weighted-average shares of the Company's common stock, unless noted otherwise. For further detail, please refer to the Company's Quarterly Report on Form 10-Q (the 'Form 10-Q'), which is available on the Investors section of the Company's website at www.GladstoneLand.com.

First Quarter 2021 Activity:

- Portfolio Activity:

- Property Acquisitions: Acquired three new farms, consisting of 233 total acres, for approximately $5.6 million. On a weighted-average basis, these farms were acquired at an initial, minimum net capitalization rate of 4.9%. However, the leases on these farms contain certain provisions (e.g., annual rent escalations or participation rents) that are expected to drive cash rents higher in future years.

- Leasing Activity-Lease Renewals: Executed four new lease agreements on certain of our farms in three different states (CA, CO, and FL) that are expected to result in an aggregate decrease in annual net operating income of approximately $92,000, or 4.3%, over that of the prior leases, all of such decrease occurred on our Colorado farms.

- Debt Activity:

- New Long-term Borrowing: Secured a total of approximately $9.9 million of new, long-term borrowings from four different lenders. On a weighted-average basis, these loans will bear interest at an expected effective interest rate of 2.96% and are fixed for the next 8.2 years.

- Issuance of Series D Term Preferred Stock and Redemption of Series A Term Preferred Stock: Completed a public offering of 2,415,000 shares of 5.00% Series D Cumulative Term Preferred Stock (the 'Series D Term Preferred Stock') for total net proceeds of approximately $58.3 million. Approximately $28.8 million of these proceeds were used to redeem all of our then-outstanding shares of 6.375% Series A Cumulative Term Preferred Stock (the 'Series A Term Preferred Stock').

- Interest Patronage: Recorded approximately $2.2 million of interest patronage, or refunded interest, related to our 2020 borrowings from various Farm Credit associations (collectively, 'Farm Credit'). In addition, during the three months ended September 30, 2020, we recorded approximately $306,000 of 2020 interest patronage, as certain Farm Credit associations prepaid a portion of the 2020 interest patronage (which related to interest accrued during 2020 but is typically received in 2021). In total, we recorded approximately $2.5 million of 2020 interest patronage related to loans from Farm Credit, which resulted in a 28.7% reduction (approximately 135 basis points) to the stated interest rates on such borrowings.

- Equity Activity:

- Series C Preferred Stock: Sold 534,971 shares of our 6.00% Series C Cumulative Redeemable Preferred Stock (the 'Series C Preferred Stock') for net proceeds of approximately $12.2 million.

- OP Units: Issued 204,778 OP Units in connection with an acquisition during the quarter, constituting a total fair value of approximately $4.0 million.

- Common Stock-ATM Program: Sold 1,312,932 shares of our common stock for net proceeds of approximately $22.3 million under our 'at-the-market' program (the 'ATM Program').

- Increased and Paid Distributions: Increased the distribution run rate on our common stock by a total of 0.11% and paid monthly cash distributions totaling $0.13485 per share of common stock during the quarter ended March 31, 2021.

First Quarter 2021 Results:

Net income for the quarter was approximately $554,000, compared to approximately $91,000 in the prior quarter. Net loss to common stockholders during the quarter was approximately $2.2 million, or $0.08 per share, compared to approximately $2.4 million, or $0.10 per share, in the prior quarter.

AFFO for the quarter was approximately $4.7 million, an increase of approximately $1.1 million, or 30.6%, from the prior quarter, while AFFO per common share increased to approximately $0.17 for the current quarter, compared to $0.15 for the prior quarter. Common stock dividends declared were approximately $0.13 per share for each quarter. The increase in AFFO was primarily driven by interest patronage amounts recorded during the current quarter related to our Farm Credit borrowings and higher lease revenues recorded during the current quarter as a result of recent acquisitions. Partially offsetting these increases were additional costs incurred in connection with financing recent acquisitions and the additional dividend expense incurred as a result of the issuance of our new Series D Preferred Stock, the proceeds of which have not yet been fully invested. AFFO per common share was further impacted by an increase in the amount of shares of common stock outstanding during the quarter as a result of additional shares issued under our ATM Program during the quarter, the proceeds of which have also not yet been fully invested.

Total cash lease revenues increased by approximately $858,000, or 5.9%, primarily due to additional fixed base cash rents earned during the current quarter from recent acquisitions, partially offset by approximately $1.2 million more of participation rents recorded during the prior quarter. Aggregate related-party fees increased by approximately $512,000 from the prior quarter, primarily driven by higher base management and incentive fees. Excluding related-party fees, our recurring core operating expenses increased by approximately $176,000 from the prior quarter, primarily due to additional property taxes recorded on certain of our properties, as well as other miscellaneous operating expenses incurred related to our recent acquisitions.

Cash flows from operations for the current quarter decreased, primarily due to the timing of when certain rental payments are scheduled to be paid pursuant to their respective leases, as well as advanced rental payments related to new acquisitions and participation rent payments both being received during the prior quarter. Our NAV per share increased by $0.46 from the prior quarter to $12.69 at March 31, 2021, primarily driven by a decrease in the fair value of our fixed, long-term borrowings due to increases in market interest rates and common equity issuances at net offering prices above our estimated NAV per common share at December 31, 2020.

Subsequent to March 31, 2021:

- Portfolio Activity:

- Property Acquisitions: Acquired one new farm, consisting of 2,285 total acres, for $37.8 million. This farm was acquired at an initial, minimum net capitalization rate of 5.3%. However, the lease on this farm contains certain provisions (e.g., annual rent escalations or participation rents) that are expected to increase cash rents in future years.

- Leasing Activity-Lease Renewal: Terminated one lease early on a farm in Michigan and immediately re-leased the property to a new tenant. The new lease is expected to result in an increase in annual net operating income of approximately $37,000, or 27.0%, over that of the prior lease.

- Equity Activity:

- Series C Preferred Stock: Sold 178,041 shares of our Series C Preferred Stock for net proceeds of approximately $4.1 million.

- Common Stock-ATM Program: Sold 1,825,452 shares of our common stock for net proceeds of approximately $36.6 million under the ATM Program.

- Increased Distributions: Increased our distribution run rate by 0.11%, declaring monthly cash distributions of $0.045 per share of common stock (including OP Units held by non-controlling OP Unitholders, if any) for each of April, May, and June 2021. This marks our 22nd distribution increase over the past 25 quarters, during which time we have increased the distribution run rate by 50.0%.

Comments from David Gladstone, President and CEO of Gladstone Land: 'The results this quarter showed the full impact of about $156 million of acquisitions that occurred during the last three weeks of 2020, coupled with extremely low interest rates that we secured in financing the acquisitions. In addition, we have been successful in the equity markets lately, particularly with our common stock, and we now have access to some low-cost capital. Our backlog of potential farm acquisitions remains strong, and we are looking forward to the participation rents coming in towards the end of this year.'

Quarterly Summary Information

(Dollars in thousands, except per-share amounts)

(1) Includes (i) cash dividends paid on our Series B and Series C Preferred Stock and (ii) the value of additional shares of Series C Preferred Stock issued pursuant to the dividend reinvestment program.

(2) Represents our pro-rata share of depreciation expense recorded in unconsolidated entities during the period.

(3) Consists primarily of (i) net property and casualty recoveries recorded, net of the cost of related repairs expensed, as a result of the damage caused to certain irrigation improvements by natural disasters on certain of our properties, (ii) one-time listing fees related to our Series D Term Preferred Stock, (iii) the write-off of certain unallocated costs related to a prior universal registration statement, and (iv) certain one-time costs related to the early redemption of our Series A Term Preferred Stock.

(4) This adjustment removes the effects of straight-lining rental income, as well as the amortization related to above-market lease values and lease incentives and accretion related to below-market lease values, deferred revenue, and tenant improvements, resulting in rental income reflected on a modified accrual cash basis. The effect to AFFO is that cash rents received pertaining to a lease year are normalized over that respective lease year on a straight-line basis, resulting in cash rent being recognized ratably over the period in which the cash rent is earned.

(5) Consists of (i) the amount of dividends on the Series C Preferred Stock paid via issuing new shares (pursuant to the dividend reinvestment program) and (ii) our remaining pro-rata share of income (loss) recorded from investments in unconsolidated entities during the period.

(6) Consists of the initial acquisition price (including the costs allocated to both tangible and intangible assets acquired and liabilities assumed), plus subsequent improvements and other capitalized costs associated with the properties, and adjusted for accumulated depreciation and amortization.

(7) Consists of the principal balances outstanding of all indebtedness, including our lines of credit, notes and bonds payable, and our Series D Term Preferred Stock.

(8) Based on gross acreage.

Conference Call for Stockholders: The Company will hold a conference call on Thursday, May 13, 2021, at 8:30 a.m. (EDT) to discuss its earnings results. Please call (877) 407-9046 to join the conference call. An operator will monitor the call and set a queue for any questions. A conference call replay will be available after the call and will be accessible through May 20, 2021. To hear the replay, please dial (877) 660-6853, and use playback conference number 13717650. The live audio broadcast of the Company's conference call will also be available online at the Company's website, www.GladstoneLand.com. The event will be archived and available for replay on the Company's website.

About Gladstone Land Corporation:

Founded in 1997, Gladstone Land is a publicly traded real estate investment trust that acquires and owns farmland and farm-related properties located in major agricultural markets in the U.S. and leases its properties to unrelated third-party farmers. The Company, which reports the aggregate fair value of its farmland holdings on a quarterly basis, currently owns 141 farms, comprised of approximately 104,000 acres in 13 different states, valued at approximately $1.2 billion. Gladstone Land's farms are predominantly located in regions where its tenants are able to grow fresh produce annual row crops, such as berries and vegetables, which are generally planted and harvested annually. The Company also owns farms growing permanent crops, such as almonds, apples, cherries, figs, lemons, olives, pistachios, and other orchards, as well as blueberry groves and vineyards, which are generally planted every 10 to 20-plus years and harvested annually. The Company may also acquire property related to farming, such as cooling facilities, processing buildings, packaging facilities, and distribution centers. Gladstone Land pays monthly distributions to its stockholders and has paid 99 consecutive monthly cash distributions on its common stock since its initial public offering in January 2013. The Company has increased its common distributions 22 times over the prior 25 quarters, and the current per-share distribution on its common stock is $0.045 per month, or $0.54 per year. Additional information, including detailed information about each of the Company's farms, can be found at www.GladstoneLand.com.

Owners or brokers who have farmland for sale in the U.S. should contact:

- Western U.S. - Bill Reiman at (805) 263-4778 or [email protected], or Tony Marci at (831) 225-0883 or [email protected];

- Midwestern U.S. - Bill Hughes at (618) 606-2887 or [email protected];

- Mid-Atlantic U.S. - Joey Van Wingerden at (703) 287-5914 or [email protected]; or

- Southeastern U.S. - Bill Frisbie at (703) 287-5839 or [email protected];

Lenders who are interested in providing us with long-term financing on farmland should contact Jay Beckhorn at (703) 587-5823 or [email protected].

For stockholder information on Gladstone Land, call (703) 287-5893. For Investor Relations inquiries related to any of the monthly dividend-paying Gladstone funds, please visit www.GladstoneCompanies.com.

Non-GAAP Financial Measures:

FFO: The National Association of Real Estate Investment Trusts ('NAREIT') developed FFO as a relative non-GAAP supplemental measure of operating performance of an equity REIT in order to recognize that income-producing real estate historically has not depreciated on the basis determined under GAAP. FFO, as defined by NAREIT, is net income (computed in accordance with GAAP), excluding gains (or losses) from sales of property and impairment losses on property, plus depreciation and amortization of real estate assets, and after adjustments for unconsolidated partnerships and joint ventures. The Company believes that FFO per share provides investors with an additional context for evaluating its financial performance and as a supplemental measure to compare it to other REITs; however, comparisons of its FFO to the FFO of other REITs may not necessarily be meaningful due to potential differences in the application of the NAREIT definition used by such other REITs.

CFFO: CFFO is FFO, adjusted for items that are not indicative of the results provided by the Company's operating portfolio and affect the comparability of the Company's period-over-period performance. These items include certain non-recurring items, such as acquisition- and disposition-related expenses, the net incremental impact of operations conducted through our taxable REIT subsidiary, income tax provisions, and property and casualty losses or recoveries. Although the Company's calculation of CFFO differs from NAREIT's definition of FFO and may not be comparable to that of other REITs, the Company believes it is a meaningful supplemental measure of its sustainable operating performance. Accordingly, CFFO should be considered a supplement to net income computed in accordance with GAAP as a measure of our performance. For a full explanation of the adjustments made to arrive at CFFO, please read the Company's Form 10-Q, filed today with the SEC.

AFFO: AFFO is CFFO, adjusted for certain non-cash items, such as the straight-lining of rents and amortizations into rental income (resulting in cash rent being recognized ratably over the period in which the cash rent is earned). Although the Company's calculation of AFFO differs from NAREIT's definition of FFO and may not be comparable to that of other REITs, the Company believes it is a meaningful supplemental measure of its sustainable operating performance on a cash basis. Accordingly, AFFO should be considered a supplement to net income computed in accordance with GAAP as a measure of our performance. For a full explanation of the adjustments made to arrive at AFFO, please read the Company's Form 10-Q, filed today with the SEC.

A reconciliation of FFO (as defined by NAREIT), CFFO, and AFFO (each as defined above) to net income (loss), which the Company believes is the most directly-comparable GAAP measure for each, and a computation of fully-diluted net income (loss), FFO, CFFO, and AFFO per weighted-average share is set forth in the Quarterly Summary Information table above. The Company's presentation of FFO, CFFO, or AFFO, does not represent cash flows from operating activities determined in accordance with GAAP and should not be considered an alternative to net income as an indication of its performance or to cash flow from operations as a measure of liquidity or ability to make distributions.

NAV: Pursuant to a valuation policy approved by our board of directors, our valuation team, with oversight from the chief valuation officer, provides recommendations of value for our properties to our board of directors, who then review and approve the fair values of our properties. Per our valuation policy, our valuations are derived based on either the purchase price of the property; values as determined by independent, third-party appraisers; or through an internal valuation process, which process is, in turn, based on values as determined by independent, third-party appraisers. In any case, we intend to have each property valued by an independent, third-party appraiser at least once every three years, or more frequently in some instances. Various methodologies are used, both by the appraisers and in our internal valuations, to determine the fair value of our real estate, including the sales comparison, income capitalization (or a discounted cash flow analysis), and cost approaches of valuation. NAV is a non-GAAP, supplemental measure of financial position of an equity REIT and is calculated as total equity available to common stockholders and non-controlling OP Unitholders, adjusted for the increase or decrease in fair value of our real estate assets and encumbrances relative to their respective costs bases. Further, we calculate NAV per share by dividing NAV by our total shares outstanding (inclusive of both our common stock and OP Units held by non-controlling third parties). A reconciliation of NAV to total equity, to which the Company believes is the most directly-comparable GAAP measure, is provided below (dollars in thousands, except per-share amount):

(1) Consists of the initial acquisition price (including the costs allocated to both tangible and intangible assets acquired and liabilities assumed), plus subsequent improvements and other capitalized costs associated with the properties, and adjusted for accumulated depreciation and amortization.

(2) As determined by the Company's valuation policy and approved by its board of directors.

(3) Includes the principal balances outstanding of all long-term borrowings (consisting of notes and bonds payable) and the Series D Term Preferred Stock.

(4) Long-term notes and bonds payable were valued using a discounted cash flow model. The Series D Term Preferred Stock was valued based on its closing stock price as of March 31, 2021.

(5) The Series B Preferred Stock was valued based on its closing stock price as of March 31, 2021, while the Series C Preferred Stock was valued at its liquidation value.

(6) Includes 27,531,951 shares of common stock and 204,778 OP Units held by non-controlling OP Unitholders.

Comparison of our estimated NAV and estimated NAV per share to similarly-titled measures for other REITs may not necessarily be meaningful due to possible differences in the calculation or application of the definition of NAV used by such REITs. In addition, the trading price of our common shares may differ significantly from our most recent estimated NAV per share calculation. The Company's independent auditors have neither audited nor reviewed our calculation of NAV or NAV per share. For a full explanation of our valuation policy, please read the Company's Form 10-Q, filed today with the SEC.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS:

Certain statements in this press release, including, but not limited to, the Company's ability to maintain or grow its portfolio and FFO, expected increases in capitalization rates, benefits from increases in farmland values, increases in operating revenues, and the increase in NAV per share, are 'forward-looking statements' within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements inherently involve certain risks and uncertainties, although they are based on the Company's current plans that are believed to be reasonable as of the date of this press release. Factors that may cause actual results to differ materially from these forward-looking statements include, but are not limited to, the Company's ability to procure financing for investments, downturns in the current economic environment, the performance of its tenants, the impact of competition on its efforts to renew existing leases or re-lease real property, and significant changes in interest rates. Additional factors that could cause actual results to differ materially from those stated or implied by its forward-looking statements are disclosed under the caption 'Risk Factors' within the Company's Form 10-K for the fiscal year ended December 31, 2020, as filed with the SEC on February 24, 2021, and certain other documents filed with the SEC from time to time. The Company cautions readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

Gladstone Land Corporation, +1-703-287-5893

SOURCE: Gladstone Land Corporation

View source version on accesswire.com:

https://www.accesswire.com/646855/Gladstone-Land-Announces-First-Quarter-2021-Results

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Atlanta Leader news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Atlanta Leader.

More InformationInternational

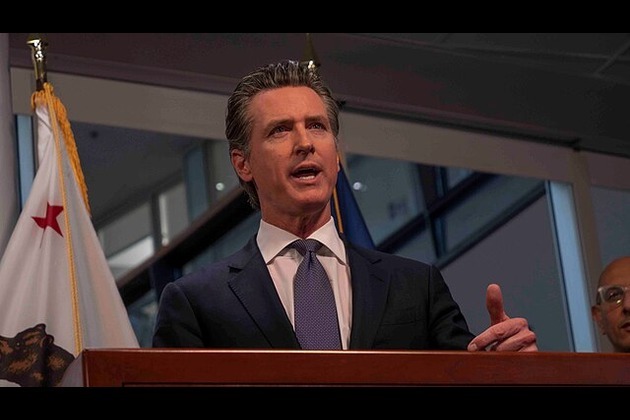

SectionFox faces $787 million lawsuit from Newsom over Trump phone call

DOVER, Delaware: California Governor Gavin Newsom has taken legal aim at Fox News, accusing the network of deliberately distorting...

DeepSeek faces app store ban in Germany over data transfer fears

FRANKFURT, Germany: Germany has become the latest country to challenge Chinese AI firm DeepSeek over its data practices, as pressure...

Canadian option offered to Harvard graduates facing US visa issues

TORONTO, Canada: Harvard University and the University of Toronto have created a backup plan to ensure Harvard graduate students continue...

Israel should act fast on new peace deals, Netanyahu says

JERUSALEM, Israel: Israeli Prime Minister Benjamin Netanyahu says that Israel's success in the war with Iran could open the door to...

UN offer rejected in Dreamliner crash investigation

NEW DELHI, India: India has decided not to allow a United Nations (UN) investigator to join the investigation into the recent Air India...

UN climate agency gets 10 percent boost amid global budget cuts

BONN, Germany: Despite widespread belt-tightening across the United Nations, nearly 200 countries agreed this week to increase the...

Business

SectionWall Street extends rally, Standard and Poor's 500 hits new high

NEW YORK, New York - U.S. stock markets closed firmly in positive territory to start the week Monday, with the S&P 500 and Dow Jones...

Canadian tax on US tech giants dropped after Trump fury

WASHINGTON, D.C.: On Friday, President Donald Trump announced that he was halting trade discussions with Canada due to its decision...

Trump-backed crypto project gets $100 million boost from UAE fund

LONDON, U.K.: A little-known investment fund based in the United Arab Emirates has emerged as the most prominent public backer of U.S....

DIY weight-loss drug trend surges amid high prices, low access

SAN FRANCISCO, California: Across the U.S., a growing number of people are taking obesity treatment into their own hands — literally....

Apple allows outside payment links under EU pressure

SAN FRANCISCO, California: Under pressure from European regulators, Apple has revamped its App Store policies in the EU, introducing...

Euro, pound surge as U.S. rate cut odds grow after Powell hint

NEW YORK CITY, New York: The U.S. dollar tumbled this week, hitting its lowest levels since 2021 against the euro, British pound, and...