F & M Bank Corp. Announces Record Annual Earnings For 2021

ACCESS Newswire

27 Jan 2022, 00:01 GMT+10

TIMBERVILLE, VA / ACCESSWIRE / January 26, 2022 / F & M Bank Corp. (OTCQX:FMBM), parent company (the Company) of Farmers & Merchants Bank today reported net income available to common shareholders of $10.5 million and diluted earnings per common share of $3.12 for the year ending December 31, 2021.

Mark Hanna, President, commented 'We are pleased with December 31, 2021 year to date earnings of $10.5 million. These results represent the most profitable year in our 114-year history. Our deposit growth of 68.3% over the last two years is significantly higher than our peers and indicative of our ability to create organic growth. We continue to focus strategically on improving our infrastructure and enhancing our digital experience as we expand our reach to acquire new banking relationships. Our greater scale, coupled with improvements in asset quality, position F&M for continued success.'

Selected financial highlights include:

- Net income of $1.3 million for the quarter ended December 31, 2021, and $10.5 million year to date.

- Total deposit increase of $50.0 million (4.85%) and $261.7 million (31.97%), respectively for the quarter and for the year.

- Total loan increase of $13.6 million (2.11%) and $31.9 (5.09%) million, respectively for the quarter and for the year (excluding PPP loans).

- Nonperforming assets decreased to 0.45% of total assets at the end of the quarter from 0.68% at year end 2020.

- Past due loans still accruing decreased to 0.48% of loans held for investment at the end of the quarter from 1.07% at year end 2020 (excluding PPP loans).

- Recovery of Provision for Loan Losses of $590,000 for the quarter and $2,821,000 year to date.

- Allowance for loan losses of 1.16% of loans held for investment (1.18% excluding PPP loans).

Balance Sheet

The Company has experienced significant deposit growth during the year. This growth enabled the Company to expand the investment portfolio as well as make strategic reductions in its long-term debt.

The Company's deposit growth has continued to exceed peer performance going back to 2019. The growth has been in noninterest bearing accounts ($33.3 million), interest bearing demand ($71.6 million) and savings and money market accounts ($163 million) with a decline in time deposits ($6.2 million). The Company continues to strategically focus on building primary banking relationships.

The investment portfolio has expanded to a balance of $413.2 million at the quarter ended December 31, 2021, which reflects growth of $295.3 million since December 31, 2020. The portfolio is a strong mix of U.S. Treasuries, Agencies, Municipals, Corporate bonds and other investments. The Company recognized $525,000 in security losses in fourth quarter of 2021, as lower yielding securities were sold and replaced with higher yielding securities to position the Company for future success.

The Company prepaid several long term FHLB borrowings to leverage our liquidity and reduce our cost of funds in future periods. These borrowings were paid down $11.3 million year to date and have a remaining balance of $10 million.

Loans held for investment; net of PPP have grown 5.09% since December 31, 2020. The Agriculture, C&I, CRE and dealer portfolios have experienced growth throughout the quarter and year to date, while the Company has seen a reduction in loan balances on 1-4 family residential secured loans during this low-rate environment.

Improvements in nonperforming loans and past due loans, as well as economic stability and improved underwriting have allowed the Company to reduce the Allowance for Loan Losses from 1.64% on December 31, 2020, to 1.18% on December 31, 2021, excluding PPP loans.

These strategies have positioned F&M for future growth in our current footprint as we continue to evaluate opportunities for expansion.

Income Statement

The 2021 earnings are driven by growth in net interest income, strong non-interest income due to our subsidiary organizations, improved asset quality and fees earned under the Paycheck Protection Program.

Net interest income reflects year over year growth. As yields on earning assets continue to decline the Company has been able to support net interest income with savings in interest expense and growth in the investment portfolio while seeking opportunities to leverage the growth in liquidity into higher yielding assets.

Margin compression has reduced the net interest margin from 3.61% on December 31, 2020, to 3.00% on December 31, 2021. To mitigate this compression, the Company has decreased its cost of funds by 24 basis points through rate adjustments, debt reduction and growth in noninterest bearing deposits.

Noninterest income of $11.8 million for the year was primarily driven by mortgage originations, growth in our wealth management division, and title division. These entities have performed well and are preparing to expand into additional areas within our Company footprint in the near future.

As stated above, continued improvements in asset quality and economic conditions resulted in the ability to reduce the allowance for loan losses to 1.16% of loans held for investment (1.18% excluding PPP loans) which was accretive to income by $2.8 million year to date, and $590 thousand in the fourth quarter.

Fees recognized under the Paycheck Protection Program (see below) totaled $212,000 for the quarter and $2.10 million year to date.

This year the Company disposed of non-income producing properties creating a loss of $333,000 and renegotiated contracts with vendors resulting in one time increases in noninterest expense of $500,000 for 2021. These moves will better position the organization for the future.

Paycheck Protection Program

The Company processed 1,080 Paycheck Protection Program ('PPP') & CARES Act loans during 2020 and 2021 totaling $87.1 million. Fees associated with these loans are amortized over the life of the loan or recognized fully when repaid or forgiven. The Company holds $7.9 million in PPP loans as of December 31, 2021 and expects to recognize approximately $225,000 in PPP fee income from these loans in 2022.

Preferred Stock Redemption

On September 1, 2021, the Company gave notice to preferred shareholders that it would redeem all Series A Preferred Stock on October 29, 2021. As a result of this announcement, 180,261 shares of the 205,327 shares of preferred stock converted to common shares and 25,066 shares were redeemed for cash.

Dividends Declaration

On January 21, 2022, our Board of Directors declared a fourth quarter dividend of $.26 per share to common shareholders. Based on our most recent trade price of $31.38 per share this constitutes a 3.31% yield on an annualized basis. The dividend will be paid on March 1, 2022, to shareholders of record as of February 14, 2022.'

F & M Bank Corp. is an independent, locally owned, financial holding company, offering a full range of financial services, through its subsidiary, Farmers & Merchants Bank's thirteen banking offices in Rockingham, Shenandoah, and Augusta Counties, Virginia and the city of Winchester, VA. The Bank also provides additional services through a loan production office located in Penn Laird, VA, a loan production office in Winchester, VA and through its subsidiaries, F&M Mortgage and VSTitle, both of which are located in Harrisonburg, VA. Additional information may be found by contacting us on the internet at www.fmbankva.com or by calling (540) 896-1705.

This press release may contain 'forward-looking statements' as defined by federal securities laws, which may involve significant risks and uncertainties. These statements address issues that involve risks, uncertainties, estimates and assumptions made by management, and actual results could differ materially from the results contemplated by these forward-looking statements. Factors that could have a material adverse effect on our operations and future prospects include, but are not limited to, changes in interest rates, general economic conditions, legislative and regulatory policies, and a variety of other matters. Other risk factors are detailed from time to time in our Securities and Exchange Commission filings. Readers should consider these risks and uncertainties in evaluating forward-looking statements and should not place undue reliance on such statements. We undertake no obligation to update these statements following the date of this press release.

F & M Bank Corp.

Key Statistics

- The net interest margin is calculated by dividing tax equivalent net interest income by total average earning assets. Tax equivalent interest income is calculated by grossing up interest income for the amounts that are nontaxable (i.e. municipal securities and loan income) then subtracting interest expense. The tax rate utilized is 21%. The Company's net interest margin is a common measure used by the financial service industry to determine how profitable earning assets are funded. Because the Company earns nontaxable interest income from municipal loans and securities, net interest income for the ratio is calculated on a tax equivalent basis as described above.

- The efficiency ratio is not a measurement under accounting principles generally accepted in the United States. The efficiency ratio is a common measure used by the financial service industry to determine operating efficiency. It is calculated by dividing non-interest expense by the sum of tax equivalent net interest income and non-interest income excluding gains and losses on the investments portfolio and Other Real Estate Owned. The Company calculates this ratio in order to evaluate how efficiently it utilizes its operating structure to create income. An increase in the ratio from period to period indicates the Company is losing a greater percentage of its income to expenses.

F & M Bank Corp.

Financial Highlights

CONTACT:

Carrie Comer EVP/Chief Financial Officer

540-896-1705 or [email protected]

SOURCE: F & M Bank Corp.

View source version on accesswire.com:

https://www.accesswire.com/685279/F-M-Bank-Corp-Announces-Record-Annual-Earnings-For-2021

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Atlanta Leader news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Atlanta Leader.

More InformationInternational

SectionOver 60 companies named in UN report on Israel-Gaza conflict

GENEVA, Switzerland: A new United Nations report alleges that dozens of global corporations are profiting from and helping sustain...

UK lawmakers desigate protest group as terrorist organization

LONDON, UK - Lawmakers in the United Kingdom have voted overwhelmingly to proscribe the direct-action group Palestine Action as a terrorist...

Dalai Lama to address Buddhist conference, reveal succession plan

DHARAMSHALA, India: The Dalai Lama is set to address a significant three-day conference of Buddhist leaders this week, coinciding with...

US Supreme Court backs Texas efforts to shield minors online

WASHINGTON, D.C.: In a significant ruling last week, the U.S. Supreme Court upheld a Texas law requiring age verification for users...

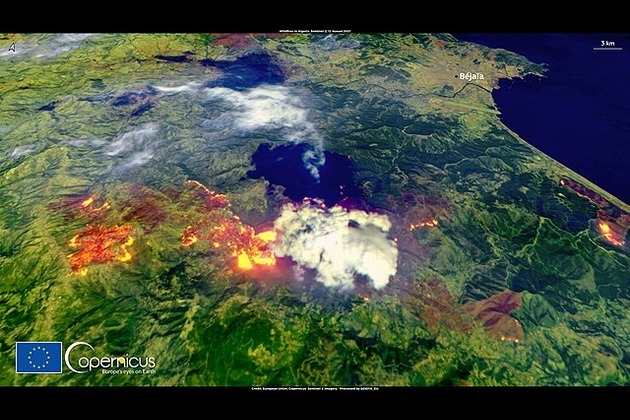

Turkey, France battle wildfires amid early Europe heatwave

ISTANBUL/PARIS/BRUSSELS: As searing temperatures blanket much of Europe, wildfires are erupting and evacuation orders are being issued...

Venetians protest Bezos wedding with march through the town

VENICE, Italy: Over the weekend, hundreds of protesters marched through the narrow streets of Venice to voice their opposition to billionaire...

Business

SectionStandard and Poor's 500 and and Nasdaq Composite close at record highs

NEW YORK, New York -U.S. stock markets closed with broad gains on Thursday, led by strong performances in U.S. tech stocks, while European...

Persson family steps up H&M share purchases, sparks buyout talk

LONDON/STOCKHOLM: The Persson family is ramping up its investment in the H&M fashion empire, fueling renewed speculation about a potential...

L'Oreal to buy Color Wow, boosts premium haircare portfolio

PARIS, France: L'Oréal is making a fresh play in the booming premium haircare segment with a new acquisition. The French beauty conglomerate...

Robinhood launches stock tokens for EU investors, adds OpenAI

MENLO PARK, California: Robinhood is giving European investors a new way to tap into America's most prominent tech names — without...

Wall Street diverges, but techs advance Wednesday

NEW YORK, New York - U.S. stocks diverged on Wednesday for the second day in a row. The Standard and Poor's 500 hit a new all-time...

Greenback slides amid tax bill fears, trade deal uncertainty

NEW YORK CITY, New York: The U.S. dollar continues to lose ground, weighed down by growing concerns over Washington's fiscal outlook...