Charge Enterprises Reports Second Quarter 2022 Financial Results

ACCESS Newswire

15 Aug 2022, 16:43 GMT+10

Reported Revenues Increased 40% to $181.0 Million

Reported Gross Margin More than Tripled to $7.3 Million

Continued Strong Execution toward Becoming the Trusted Infrastructure Provider in Expansive EV Charging and 5G Broadband Space

NEW YORK, NY / ACCESSWIRE / August 15, 2022 / Charge Enterprises, Inc. (Nasdaq:CRGE) ('Charge' or the 'Company'), today reported second quarter 2022 revenues of $181.0 million, compared with $129.6 million in the second quarter of 2021. Gross margin increased to $7.3 million, compared with $2.2 million in the prior year period.

'We delivered exceptional second-quarter results through expanded orders from existing customers and new business in both the Telecommunications and EV Infrastructure sectors,' said Andrew Fox, Founder, Chairman and Chief Executive Officer. 'Charge Enterprises' approach is investment in foundational infrastructure, specifically 5G service and EV charging, and working with businesses that will spread these technologies quickly. Our customer base includes large global telecom carriers, mobile operators, and federal contractors, as well as automotive OEMs, dealerships, and fleet operators.'

'Our core strategy is solid, we're focused on organic growth, levering subsidiary expertise, and investing in high growth areas,' he said. 'A key Charge initiative is our Network Operations Center (‘NOC'), where we provide our customers with high-quality maintenance and service when, how and where they want it, which generates monthly recurring revenue for our business.'

According to Fox, the upcoming years represent a pivotal period for EV charging and 5G broadband infrastructure. 'Heavy investment will flow into this space from both public and private sources, and we're positioning Charge Enterprises to be the trusted infrastructure provider, which is why we're investing in new systems and advanced technologies and why we provide ongoing maintenance ensuring our customers experience seamless around the clock operation.'

Second Quarter 2022 Results - Selected Financial Information

(1) Adjusted EBITDA represents income (loss) before interest, income taxes, depreciation and amortization, and amortization of debt discount and debt issue costs adjusted for stock-based compensation, loss on impairment, (income) loss from investments, net, other (income) expense, net, and foreign exchange adjustments. Refer to Appendix for definition and complete non-GAAP reconciliation for Adjusted EBITDA.

Reported financial results include operations from the date of acquisition: Advanced Network Services ('ANS') acquired on May 21, 2021; BW Electrical Services ('BW') acquired on December 27, 2021; and EV Group Holdings ('EV Depot') acquired on January 14, 2022. Due to the timing of certain acquisitions, current quarter results are not necessarily comparable to the year-ago periods.

Proforma financial results include: the full three and six months periods for all of the Company's operations, including acquisitions, for 2021 and 2022 as if they happened on the first day of the respective period. Management believes that presenting proforma results is important to understanding the Company's financial performance and provides better analysis of trends in the Company's underlying businesses as it allows for comparability to prior period results.

Reported revenues increased $51.5 million to $181.0 million in the quarter, and proforma revenues increased $38.4 million to $181.0 million, compared with the second quarter of 2021. The increase in reported and proforma revenues was driven by higher revenues in both of the Company's business segments.

- Telecommunications : Reported revenues and proforma revenues increased $29.6 million, compared with the second quarter of 2021. The increase was primarily driven by higher wholesale traffic volumes, as a result of geo-political unrest in various regions of the world.

- Infrastructure : Reported revenues increased $21.8 million, and proforma revenues increased $8.8 million, compared with the second quarter of 2021. The seven-fold increase in reported revenues was due to the Company's acquisitions of ANS, BW, and EV Depot. The 53% increase in proforma revenues demonstrates the success of the Company's strategy to drive organic growth.

Reported gross margin increased $5.1 million to $7.3 million, and proforma gross margin increased $1.7 million to $7.3 million, compared with the second quarter of 2021. The increase in reported and proforma gross margin was primarily driven by higher revenues and margin expansion in the Company's Infrastructure business segment, partially offset by lower gross margin in its Telecommunications business segment.

Reported net loss was $19.6 million, compared with a net loss of $10.1 million in the prior year period, and proforma net loss was $19.6 million, compared with a net loss of $8.4 million in the second quarter of 2021. On a reported basis, the incremental expenses after gross margin were primarily related to investments the Company continued to make in its people and capital structure, positioning Charge for growth. The largest drivers over the prior year period were:

- $9.8 million in stock-based compensation expense, which represented a $0.5 million increase;

- $3.9 million in general and administrative expense, which represented a $1.8 million increase;

- $4.1 million in salaries and related benefits, which represented a $2.3 million increase, driven by the Company's growth, and acquisitions of ANS, BW, and EV Depot; and

- $7.2 million in total other expense, net, which represented a $6.8 million increase, and included a $4.3 million non-cash charge related to the exchange of convertible notes for preferred equity, allowing the Company to move towards a more favorable capital structure.

The reported net loss of $19.6 million, adjusted for non-cash and certain one-time items, resulted in an Adjusted EBITDA loss of $1.6 million, compared with an Adjusted EBITDA loss of $2.4 million in the prior year period. See Appendix for full reconciliation.

As of June 30, 2022, Charge held $62.9 million in cash, cash equivalents and marketable securities.

Charge's CFO Leah Schweller commented, 'During the quarter, our operating subsidiaries' core business models continued to drive proforma organic growth and margin. In addition, we increased our market share, adding additional value through the collaboration between our ANS and BW teams, achieving new revenue growth. It is notable that we were able to improve profitability, within the context of inflation and labor challenges that impacted our entire industry. We continued to invest the incremental gross margin dollars we achieved primarily in our infrastructure businesses and to some extent at the corporate level to build out the overall Company foundation.'

To support our growth plans, meet evolving customer needs and position us well in the marketplace, we are pursuing additional opportunities to expand our product offerings. We are addressing the increasing demand for maintenance and monitoring services through our NOC and expanding our global Telecommunications business with the execution of Short Message Services (SMS) agreements for commercial use in Application to Person (A2P) messaging.'

For further details of the Company's financials, please see Charge Enterprises' Quarterly Report on Form 10-Q for the quarter ended June 30, 2022, filed with the Securities and Exchange Commission on August 15, 2022 and available on Charge's website Charge | SEC Filings . Financial statements prior to December 31, 2021 were filed with the OTC Markets.

Second Half 2022 and 2023 Priorities

Charge serves a large addressable market with an urgent need for updated infrastructure at the crossroads of EV Charging and Communications. This combined sector is propelled by strong tailwinds from private and public spending.

Charge's mission over the next 18 months remains focused on the execution of being the trusted infrastructure provider in the EV charging and 5G broadband space. The Company's strategy is to integrate and optimize value from high-quality assets with growing recurring revenue streams across its core competencies by:

- Executing seamlessly for Telecommunications and Infrastructure customers;

- Broadening its value proposition to meet evolving customer needs, adding capabilities both through internal development and targeted strategic and opportunistic M&A to optimize Charge's competitive edge as a trusted advisor;

- Proceeding at a measured and methodical pace to build a healthy foundation with refined processes

for sustained long-term growth; and

- Development of new software products and services.

About Charge Enterprises, Inc.

Telecommunications

Our Telecommunications business ('Telecommunications') has provided routing of both voice and data to Carriers and Mobile Network Operators ('MNOs') globally for over two decades and is poised to selectively add profitable products and services to this long-established business.

Infrastructure

Our Infrastructure business ('Infrastructure') has a primary focus on two fast growing sectors: electric vehicle ('EV') charging, and Telecommunications Network 5G, including cell tower, small cell, and in-building applications. Solutions for these two sectors include: Design and Engineering, Equipment Specification and Sourcing, Installation, Data and Software Solutions, and Service and Maintenance.

To learn more about Charge, visit Charge Enterprises , Inc.

Notice Regarding Forward-Looking Information

This press release contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements reflect current expectations or beliefs regarding future events or Charge's future performance. Often, but not always, forward-looking statements can be identified by the use of words such as 'plans', 'expects', 'is expected', 'budget', 'scheduled', 'estimates', 'continues', 'forecasts', 'projects', 'predicts', 'intends', 'anticipates', 'targets' or 'believes', or variations of, or the negatives of, such words and phrases or state that certain actions, events or results 'may', 'could', 'would', 'should', 'might' or 'will' be taken, occur or be achieved. All forward-looking statements, including those herein, are qualified by this cautionary statement.

Although Charge believes that the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements involve risks and uncertainties, and actual results may differ materially from any future results expressed or implied by such forward-looking statements. Such risks and uncertainties include the business plans and strategies of Charge, Charge's future business development, market acceptance of electric vehicles, Charge's ability to generate profits and positive cash flow, changes in government regulations and government incentives, subsidies, or other favorable government policies, and other risks discussed in Charge's filings with the U.S. Securities and Exchange Commission ('SEC'). Readers are cautioned that the foregoing list of risks and uncertainties is not exhaustive of the factors that may affect forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements. The forward-looking statements in this press release speak only as of the date of this press release or as of the date or dates specified in such statements. For more information on us, investors are encouraged to review our public filings with the SEC which are available on the SEC's website at www.sec.gov . Charge disclaims any intention or obligation to update or revise any forward- looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Notice Regarding Non-GAAP Measures

The press release includes both financial measures in accordance with U.S. generally accepted accounting principles ('GAAP'), as well as non-GAAP financial measures. These non-GAAP financial measures are in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. See the Appendix for a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures. These non-GAAP financial measures may be different from non-GAAP financial measures used by other companies.

Media Contacts:

Steve Keyes (248) 952-7022

[email protected]

Investor Relations:

Christine Cannella (954) 298-6518

[email protected]

Carolyn Capaccio, CFA (212) 838-3777

[email protected]

APPENDIX

CHARGE ENTERPRISES, INC.

CONSOLIDATED RESULTS OF OPERATIONS

CHARGE ENTERPRISES, INC.

SEGMENT RESULTS OF OPERATIONS

Infrastructure

Non-Operating Corporate

CHARGE ENTERPRISES, INC.

CONSOLIDATED BALANCE SHEETS

(Unaudited)

CHARGE ENTERPRISES, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

CHARGE ENTERPRISES, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

Non-GAAP Measures

In this press release, the Company has supplemented the presentation of its financial results calculated in accordance with U.S. generally accepted accounting principles ('GAAP') with the following financial measures that are not calculated in accordance with GAAP: EBITDA and Adjusted EBITDA. Management uses both GAAP and non-GAAP measures to assist in making business decisions and assessing overall performance. The Company's measurement of these non-GAAP financial measures may be different from similarly titled financial measures used by others and therefore may not be comparable. These non-GAAP financial measures should not be considered superior to the GAAP measures in the tables included within this material.

Certain information presented in this press release reflects adjustments to GAAP measures such as EBITDA and Adjusted EBITDA as an additional way of assessing certain aspects of the Company's operations that, when viewed with the GAAP financial measures, provide a more complete understanding of its on-going business. EBITDA is defined as income (loss) before interest, income taxes, depreciation and amortization, and amortization of debt discount and debt issue costs. Adjusted EBITDA represents EBITDA adjusted for stock-based compensation, income (loss) from investments, net, other (income) expense, net, and foreign exchange adjustments.

CHARGE ENTERPRISES, INC.

NON-GAAP RECONCILIATION

SOURCE: Charge Enterprises Inc.

View source version on accesswire.com:

https://www.accesswire.com/712007/Charge-Enterprises-Reports-Second-Quarter-2022-Financial-Results

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Atlanta Leader news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Atlanta Leader.

More InformationInternational

SectionNative leaders, activists oppose detention site on Florida wetlands

EVERGLADES, Florida: Over the weekend, a diverse coalition of environmental activists, Native American leaders, and residents gathered...

Beijing crowds cheer AI-powered robots over real soccer players

BEIJING, China: China's national soccer team may struggle to stir excitement, but its humanoid robots are drawing cheers — and not...

COVID-19 source still unknown, says WHO panel

]LONDON, U.K.: A World Health Organization (WHO) expert group investigating the origins of the COVID-19 pandemic released its final...

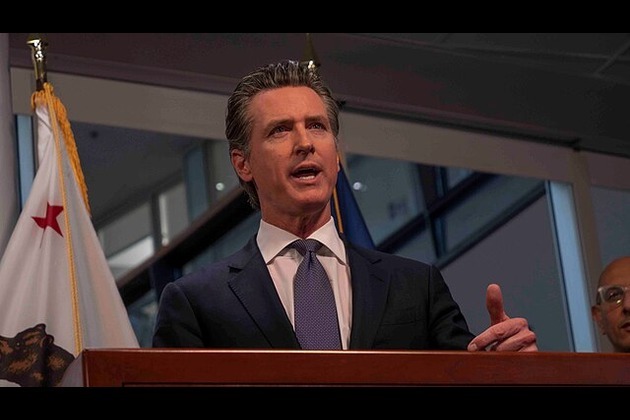

Fox faces $787 million lawsuit from Newsom over Trump phone call

DOVER, Delaware: California Governor Gavin Newsom has taken legal aim at Fox News, accusing the network of deliberately distorting...

DeepSeek faces app store ban in Germany over data transfer fears

FRANKFURT, Germany: Germany has become the latest country to challenge Chinese AI firm DeepSeek over its data practices, as pressure...

Canadian option offered to Harvard graduates facing US visa issues

TORONTO, Canada: Harvard University and the University of Toronto have created a backup plan to ensure Harvard graduate students continue...

Business

SectionTech stocks slide, industrials surge on Wall Street

NEW YORK, New York - Global stock indices closed with divergent performances on Tuesday, as investors weighed corporate earnings, central...

Canada-US trade talks resume after Carney rescinds tech tax

TORONTO, Canada: Canadian Prime Minister Mark Carney announced late on June 29 that trade negotiations with the U.S. have recommenced...

Lululemon accuses Costco of selling knockoff apparel

Vancouver, Canada: A high-stakes legal showdown is brewing in the world of athleisure. Lululemon, the Canadian brand known for its...

Shell rejects claim of early merger talks with BP

LONDON, U.K.: British oil giant Shell has denied reports that it is in talks to acquire rival oil company BP. The Wall Street Journal...

Wall Street extends rally, Standard and Poor's 500 hits new high

NEW YORK, New York - U.S. stock markets closed firmly in positive territory to start the week Monday, with the S&P 500 and Dow Jones...

Canadian tax on US tech giants dropped after Trump fury

WASHINGTON, D.C.: On Friday, President Donald Trump announced that he was halting trade discussions with Canada due to its decision...