U.S. stocks tumble as Trump policies startle investors

Lola Evans

22 Feb 2025, 02:51 GMT+10

- The tech-heavy NASDAQ Composite dropped 438.36 points to close at 19,524.01, registering a 2.20 percent decline.

- The Dow Jones Industrial Average also declined, ending the day at 43,428.02—a loss of a whopping 748.63 points or 1.69 percent.

- The Standard and Poor's 500 finished at 6,013.13, down 104.39 points or 1.71 percent.

NEW YORK, New York - Concerns over U.S. President Donald Trump's startling diversions from his country's long-held policies, and the threat of new tariffs, together with economic data showing consumer sentiment in retreat, and business activity declining, drove North American markets sharply lower Friday.

"I don't like all this red on a Friday," Greg Bassuk, CEO at AXS Investments in New York told Reuters news agency Friday. "We're seeing consumer sentiment, tariffs and corporate earnings having leap-frogged AI and technology as the primary drivers of market direction."

All major U.S. indices closed in negative territory amid investor caution.

The Standard and Poor's 500 finished at 6,013.13, down 104.39 points or 1.71 percent, with trading volume reaching 3.352 billion shares.

The Dow Jones Industrial Average also declined, ending the day at 43,428.02—a loss of a whopping 748.63 points or 1.69 percent—with a volume of 618.46 million shares.

Meanwhile, the tech-heavy NASDAQ Composite dropped 438.36 points to close at 19,524.01, registering a 2.20 percent decline on robust trading of 7.714 billion shares.

Global FX Markets See Mixed Movements on Friday

Foreign exchange markets around the world closed Friday with a mixed bag of results as key currency pairs posted modest gains and losses amid a climate of cautious investor sentiment.

Euro and US Dollar Dynamics

The EURUSD pair last traded at 1.0460 as the euro fell by 0.38 percent against the U.S. dollar, reflecting ongoing concerns over economic recovery prospects.

Meanwhile, the USDJPY pair settled at 149.13 with the dollar down by 0.33 percent relative to the Japanese yen, signaling a modest shift as traders adjusted their risk positions.

Conversely, he U.S. dollar appreciated against the Canadian dollar. The USDCAD pair climbed to 1.4227, up by 0.42 percent, as markets reacted to favorable economic data from the United States.

At the same time, the British pound struggled, with the GBPUSD pair recording 1.2630, down by 0.29 percent, underscoring persistent uncertainties amid ongoing political and economic debates in the United Kingdom.

Safe-Haven and Commodity-Linked Currencies

The U.S. dollar eased slightly against the Swiss franc, with the USDCHF pair settling at 0.8970, a decline of 0.08 percent.

In the Oceania region, both the Australian dollar and the New Zealand dollar fell. The AUDUSD pair traded at 0.6357, down by 0.65 percent, while the NZDUSD pair was at 0.57414, declining by 0.35 percent, highlighting regional pressures on commodity-linked currencies.

Overall, Friday's trading session in the foreign exchange market underscores a continued state of flux, with investors weighing global economic data and central bank signals. Market participants remain alert as economic indicators and geopolitical developments are expected to drive further volatility in the coming days.

Global markets close mixed Friday with movements contained, except in Canada where large falls were experienced

Global markets closed Friday with a mix of modest gains and slight declines as investors reacted cautiously amid ongoing economic uncertainty.

Canada

Across the border in Canada, the S&P/TSX Composite index closed at 25,147.03, sliding 367.05 points or 1.44 percent, with 262.467 million shares exchanging hands.

UK and European Markets

In the United Kingdom, the FTSE 100 ended the session at 8,659.37 after falling by 3.60 points—a decline of 0.04 percent.

Over in Germany, the DAX P slipped by 27.09 points to close at 22,287.56, down 0.12 percent.

French equities fared better, with the CAC 40 rising by 31.93 points to finish at 8,154.51, an increase of 0.39 percent.

The broader eurozone was similarly mixed as the EURO STOXX 50 I gained 13.82 points to settle at 5,474.85, up 0.25 percent.

Elsewhere, the Euronext 100 Index advanced by 3.45 points to reach 1,593.41, up 0.22 percent, while Belgium's BEL 20 added 36.04 points to close at 4,405.39, up 0.82 percent.

Asian Markets

Asian markets showed divergent trends. Hong Kong's HANG SENG INDEX surged by 900.94 points to finish at 23,477.92, a robust increase of 3.99 percent.

In Singapore, the STI Index edged up by 2.43 points to close at 3,929.94, up 0.06 percent.

Turning to the Asian heavyweight indices, China's SSE Composite Index advanced by 28.33 points to end at 3,379.11, up 0.85 percent on a substantial trading volume of 689.478 million shares. Japan's Nikkei 225 edged higher by 98.90 points to finish at 38,776.94, up 0.26 percent.

In the Indian subcontinent, the S&P BSE SENSEX dropped by 424.90 points to finish at 75,311.06, down 0.56 percent, whereas Indonesia's IDX COMPOSITE managed a modest gain of 14.96 points to close at 6,803.00, up 0.22 percent.

In Malaysia the FTSE Bursa Malaysia KLCI advanced by 13.36 points to end at 1,591.03, up 0.85 percent,.

South Korea's KOSPI Composite Index inched up by 0.52 points to settle at 2,654.58, a slight increase of 0.02 percent, despite trading volume of 444,704 shares. Taiwan's TWSE Capitalization Weighted Stock Index showed a more robust performance, rising by 242.79 points to close at 23,730.25, up 1.03 percent. South Africa's Top 40 USD Net TRI Index recorded a gain of 13.12 points to finish at 4,775.06, up 0.28 percent.

Oceania

Australia's S&P/ASX 200 dipped by 26.60 points to settle at 8,296.20, down 0.32 percent, while the Australian ALL ORDINARIES lost 30.80 points to end at 8,570.90, a decline of 0.36 percent.

In New Zealand the S&P/NZX 50 INDEX GROSS fell by 127.78 points to finish at 12,752.58, a decline of 0.99 percent.

Middle East

Middle East markets were mostly closed on Friday and will reopen on Sunday.

African Markets

The JNOU.JO in South Africa advanced 13.12 points or 0.28 percent Friday to close at 4,775.06.

Currency and Other Indices

In currency markets, the US Dollar Index increased by 0.24 points to 106.62, up 0.23 percent. The MSCI EUROPE index climbed by 7.67 points to close at 2,212.91, an increase of 0.35 percent. However, both the British Pound Currency Index and the Euro Currency Index experienced declines—falling by 0.32 and 0.37 points to close at 126.34 (down 0.26 percent) and 104.63 (down 0.35 percent), respectively.

In currency-specific performance, the Japanese Yen Currency Index appreciated by 0.21 points to 67.05, up 0.31 percent, while the Australian Dollar Currency Index fell by 0.41 points to settle at 63.57, down 0.64 percent.

Market Outlook

The varied performance across these major indices highlights the delicate balance of risk and opportunity that investors face amid evolving economic conditions. With central bank policies and key economic data on the horizon, market participants are bracing for potential volatility in the coming week.

Overall, Friday's trading session served as a reminder of the global markets' interconnected nature, where gains in one region can be offset by declines in another, painting a complex picture of investor sentiment worldwide.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Atlanta Leader news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Atlanta Leader.

More InformationInternational

SectionTrump orders U.S. to join Netanyahu's war on Iran

WASHINGTON, DC - U.S. President Donald Trump how bowed to pro-Israel elements in his administration and Congress, announcing that the...

Swiss National Bank responds to strong franc and US trade doubts

ZURICH, Switzerland: The Swiss National Bank (SNB) lowered its key interest rate to zero percent on June 19 to respond to falling inflation,...

New U.S. guidelines may cut daily alcohol limit from advice

WASHINGTON, D.C.: The U.S. government is preparing to revise its influential dietary advice, with a significant shift: dropping the...

UBS: Over 379,000 Americans became millionaires last year

ZURICH, Switzerland: The U.S. saw an extraordinary rise in wealth last year, with more than 1,000 people crossing into millionaire...

The Hague faces lockdown for global leaders' meet

THE HAGUE, Netherlands: The city that prides itself on being a beacon of peace and justice—home to institutions like the International...

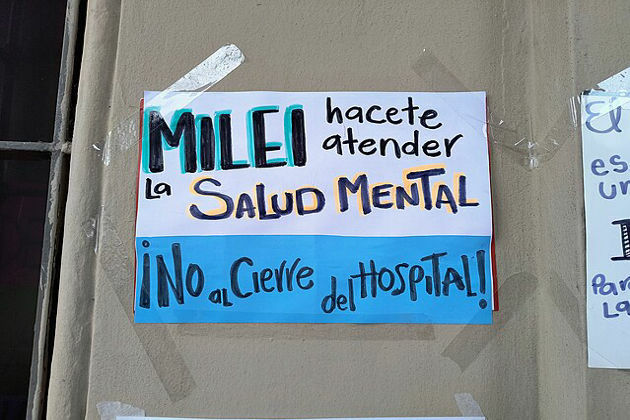

Drug shortages and layoffs spark health crisis in Argentina

BUENOS AIRES, Argentina: Since taking office in December 2023, Argentine President Javier Milei has implemented sweeping austerity...

Business

SectionTikTok gets US reprieve as Trump grants 90-day extension

WASHINGTON, D.C.: President Donald Trump has granted TikTok another reprieve, extending the deadline for its Chinese parent company,...

Next-gen weight-loss drugs aim to cut fat, spare muscle

WASHINGTON, D.C.: As the global weight-loss market explodes, drugmakers are now racing to solve a less visible problem: protecting...

Amazon’s Zoox unveils plan to build 10,000 robotaxis a year

HAYWARD, California: In a significant step toward its commercial debut, Amazon-owned Zoox has unveiled its first factory dedicated...

Brazil aims to restart poultry trade after bird flu clearance

SAO PAULO, Brazil: Brazil is taking confident steps to restore its dominance in global poultry exports after declaring its commercial...

U.S. stocks restricted by tensions in Middle East

NEW YORK, New YorK - U.S. stocks closed mixed on Friday, with gains and losses modest, as investors and traders weighed up the escalation...

US consumers cut back after early surge ahead of Trump tariffs

WASHINGTON, D.C.: Retail sales dropped sharply in May as consumer spending slowed after a strong start to the year, primarily due to...